Making Tax Digital is evolving. We saw MTD-compatible technology take the industry by storm in 2019, and now it’s advancing even further with MTD for ITSA being introduced in April 2024.

Whilst this may seem like some time away, it’s worth getting ahead and preparing with your clients in advance, for a smoother and more seamless transition.

A recap of the MTD timeline:

2019: MTD came into play and required VAT-registered businesses to keep digital records via MTD-compatible software. This meant businesses could submit their VAT returns electronically.

2022: The scope of MTD for VAT expanded and now all VAT-registered businesses are required to follow these rules.

2022: MTD for Income Tax was introduced, giving outlines of how the current system will be replaced by annual Self Assessment tax returns.

2024: MTD ITSA will come into effect for self-employed business owners and landlords.

2025: MTD ITSA will come into effect for partnerships with individual partners.

2026: It’s expected that MTD for Corporation Tax will come into play, but nothing has been outlined yet.

What this means for your business and clients

- By April 2024, if you have an income of over £10k on your tax return, clients have to file quarterly returns regarding business income and expenses.

- People who currently pay their tax accountant once a year will now have to do this quarterly.

- Clients will have to finalise their business income by submitting an end-of-period statement (EOPS)

- They will also need to submit a final declaration at the end of the tax year.

The challenges sweeping the industry

Whilst the deadline is set, HMRC hasn’t issued much guidance on the new requirements, which is making it difficult for accountants to fully prepare. This has created a limbo period ahead of the April 2024 deadline. What we do know, is that business income and expenses must be in a digital format, so any firms that don’t currently have this need to change their processes. Digital record keeping needs to be the norm. Whilst this may seem daunting and sounds like a lot of change, there is a real opportunity here for firms to look at the bigger picture of how processes are carried out across the whole business.

On the subject of change, there is a reluctance from accountants to change, as the new system seems more complicated, and there will have to be more conversations with clients about how it will work. Alongside this, choosing the right software without the full guidelines means firms have to take risks. In a conversation with Chris Smith, Director of Personal Tax Compliance at BKL, he commented that "MTD is one of the biggest challenges to self-assessment since its creation, and it is important that businesses have relevant software that can manage this change for their practice and also their clients."

Take comfort in the technology available

- The only way to keep costs down is to use technology that allows for auto filing, or a web portal to automate the filing. Customers are not going to want to pay 4 times the price.

- Firms don’t have to hire 4 times as many people, and if they did then recruitment would be a nightmare.

- Firms also don’t have to deal with 4x the workload

- If the tech does nothing, teams will be overwhelmed, so it seems logical to turn to the available technology.

- With the ability to automate manual things, accountants will save time, clients do the work at their own expense, and ultimately the client experience improves as automation will do the heavy lifting.

The solution: Practice Gateway

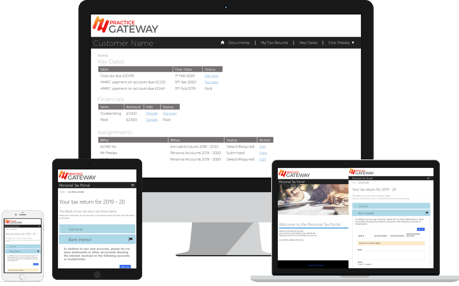

Practice Gateway is a client portal (created by T-Tech developers), that unifies everything in one place between accountant and client. Clients can complete HMRC submissions, make payments, securely access and upload documents, run AML checks, and more within the Practice Gateway portal. It integrates with other key accounting software like CCH and Digita, and can be accessed on the go, whether on your mobile or desktop.

Practice Gateway is a client portal (created by T-Tech developers), that unifies everything in one place between accountant and client. Clients can complete HMRC submissions, make payments, securely access and upload documents, run AML checks, and more within the Practice Gateway portal. It integrates with other key accounting software like CCH and Digita, and can be accessed on the go, whether on your mobile or desktop.

For accountants, it synchronizes client data with your other tax software, creates a single source of truth from disparate systems, and manages document approvals and other processes that previously would have been carried out manually. For clients, they can use Practice Gateway to easily and safely send tax information to their trusted accountant, upload personal files, and make payments.

With firms such as BKL and Evelyn Partners using Practice Gateway, they have noticed an improvement in the client experience, and positive reception from personal tax advisors to adopting this new way of interacting with customers. Chris also commented, "T-Tech has a proven track record of being forward thinking and adaptive to the market".

How Practice Gateway will support MTD for ITSA

- For clients, they can use Practice Gateway to easily and safely send information to their accountant and do this as frequently as possible. This makes the quarterly filing easier.

- It is entirely convenient for both parties. If you’ve got to carry out the process quarterly, you can both access and store files on a day-to-day basis. The client can upload and manage personal files and documents whenever and wherever. It makes it a lot easier when the time comes to file returns, as everything is traceable.

- The mobile app and “on-the-go” feature is a real-time digital data collection that allows you to quickly record data as you go for the specific schedules which HMRC has requested. It’s as easy as using your phone camera to upload photos of documents.

- Practice Gateway will allow for automated completion of the annual form from the MTD submissions, and will also allow the previous quarter to be rolled forwards so that if you look at property income, you won’t have to do anything, just check it and press submit.

- The development team is always working on advancing and adding new features, which will make things a lot easier as HMRC guidelines become more rigid.

What are you waiting for?

Get ahead of the curve and prepare your clients early. Practice Gateway will do the heavy lifting, so you don’t have to. Want to learn more about how it works? Speak to one of our automation experts today.

.png?width=168&name=T-TECH%20logo%20(no%20strapline).png)